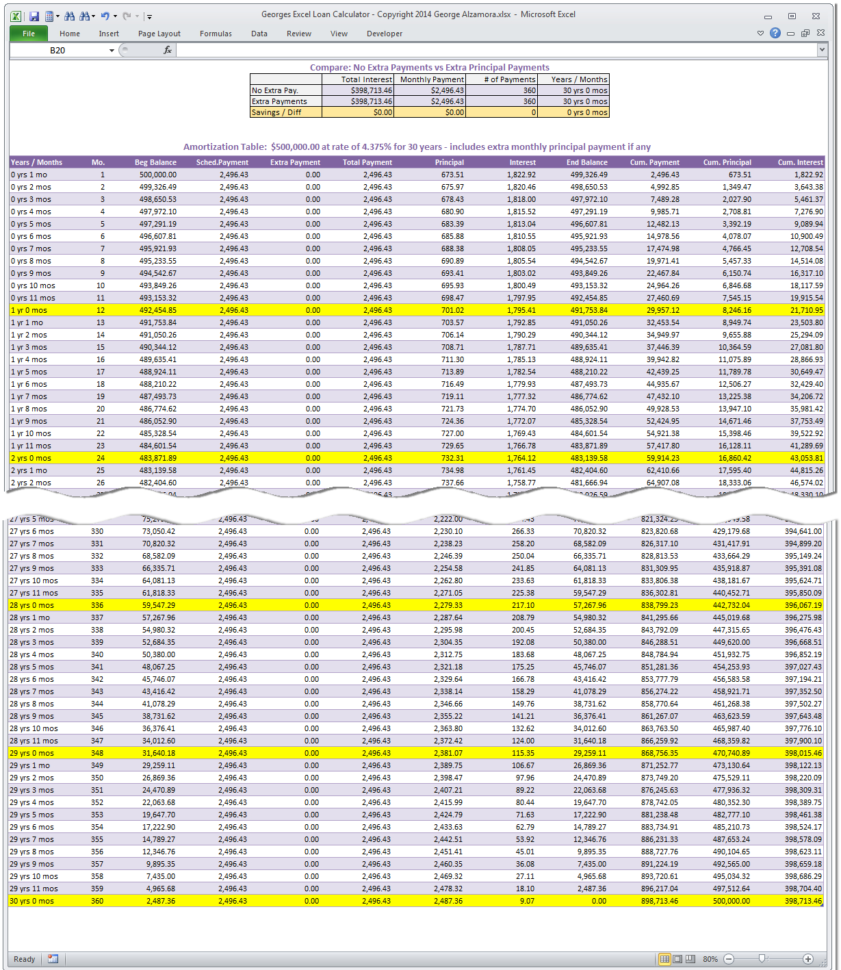

Or consider a $600,000 loan amount set at 6% for 30 years. If you had a $300,000 loan amount set at 4.5% on a 30-year fixed, paying an extra $250 per month would save you almost $70,000 and you’d pay off your loan seven years and six months ahead of schedule. If you had a $400,000 loan amount set at 4% on a 30-year fixed, paying an extra $100 per month would save you nearly $30,000 and you’d pay off your loan two years and eight months early.

#Increasing extra payment mortgage calculator full#

If you paid an extra $500 per month, you’d save around $153,000 over the full loan term and it would result in a full payoff after about 21 years and three months. Imagine a $500,000 mortgage with a 30-year fixed interest rate of 5%. Once you click compute, you’ll see how much the extra mortgage payments will save in the way of interest over the life of the loan, and also how much faster you’ll pay off your mortgage.

If you want to make a lump sum extra payment of $1,000, enter it and change the “Monthly” to “One Time” for an accurate calculation.

Then input the additional payment amount and whether it’ll be a monthly, annual, or one-time extra payment.įor example, if you plan to pay an extra $100 per month, you shouldn’t have to change anything with the default settings. Next, enter the mortgage rate and the date you plan to make the extra (or larger) payment. It will depend on the mortgage rate and the loan balance. Of course, that’s just a ballpark estimate. So if you’re currently paying $1,000 per month in principal and interest payments, you’d have to pay roughly $1,500 per month to cut your loan term in half.

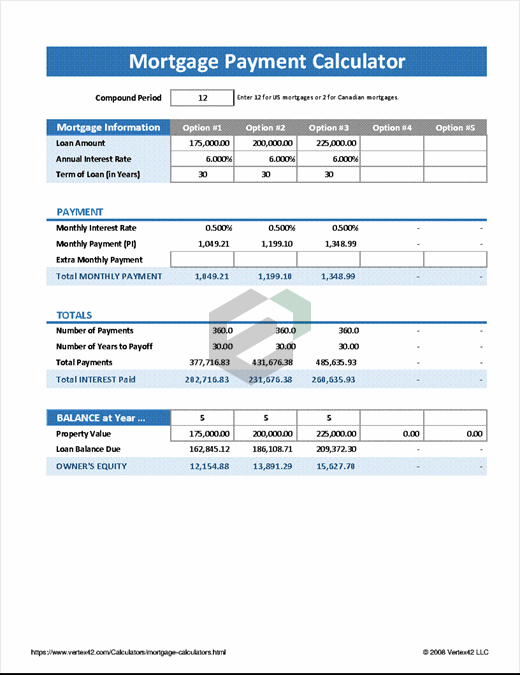

If you own real estate and are considering making extra mortgage payments, the “early mortgage payoff calculator” below could be helpful in determining how much you’ll need to pay and when to meet a certain financial goal.

0 kommentar(er)

0 kommentar(er)